How to Effectively Prune Your Embedded Product Portfolio

In embedded computing, product pruning is the selective removal of certain products that no longer contribute to the health and growth of a company. Product families that are generating little or no profit for the company because of production complications, small market share, and/or outdated function can harm an embedded computer manufacturer’s bottom line. The perpetuation of these products in their respective companies causes a drain of energy, money, and resources from sales, engineering, and manufacturing—energy that could be utilized to improve product quality, accelerate time to market, and energize new product introduction.

In embedded computing, product pruning is the selective removal of certain products that no longer contribute to the health and growth of a company. Product families that are generating little or no profit for the company because of production complications, small market share, and/or outdated function can harm an embedded computer manufacturer’s bottom line. The perpetuation of these products in their respective companies causes a drain of energy, money, and resources from sales, engineering, and manufacturing—energy that could be utilized to improve product quality, accelerate time to market, and energize new product introduction.

Although some companies hold on to energy-draining, discontinued products, some utilize heavy-handed hatchet processes to force customers to stop requesting the products they need. When accounting for all the resources required to produce these older designs, practices such as multiple end-of-life notices, last-time buys, and costly component prestocking are used to keep orders filled. However, these orders often barely meet the minimum quantities required to break even. This approach squeezes as much revenue out of products as possible but fails to consider the opportunity costs of distracted resources from high-yielding product lines (such as new products). The longer a low-performing older product lingers, the more it negatively affects a company’s growth potential and future revenue.

Moreover, these traditional approaches do not work because they place the Original Equipment Manufacturer (OEM) in a position to support customer demand for these older designs while optimizing growth. These two activities contradict each other when supporting legacy products. Although traditional pruning leaves the customer in the dirt, product pruning with a partner focused on legacy equipment manufacturing not only allows the customer to satisfy their needs but also helps the OEM free up corporate growth and improve corporate health, bottom-line profit, market share of top-earning products, product quality, and manufacturing throughput.

The key to a successful product prune relies not only on identifying mature products at the right time but also on having a partner to extend the life of a product that is dragging down OEM performance.

How to perform product pruning

Successful product pruning requires a general understanding of the financial state of your company and the processes and policies to support that understanding. Knowing when and how to prune your product portfolio is a balancing act that requires a clear understanding of the true cost of continuing to manufacture older products with decreasing demand while keeping business and quality objectives in the lead—where they should be.

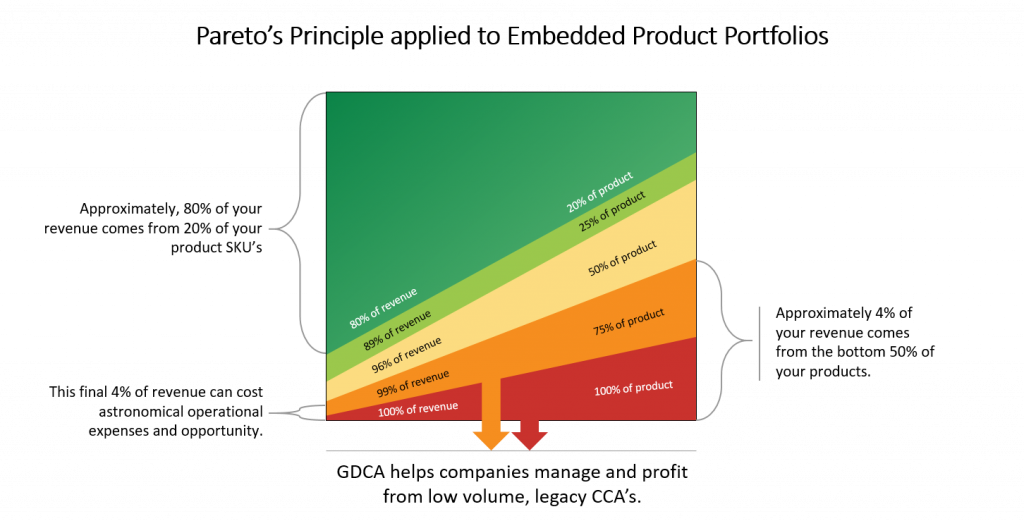

Pareto’s principle has been examined in various business practices, but in relation to products, a general understanding is that 80% of revenue comes from 20% of product, primarily core products. Of the remaining product portfolio, products that have been discontinued will generate less than 10% profit. As customers move away from the most valuable products, the revenue per product drops while the resources required to support the product increase rapidly—especially as the product continues to age.

Knowing which core and legacy products to support is imperative for companies that want to succeed in the market. To help find the balance, it is critical that the right stakeholders are involved in creating the strategy that supports the pruning process. Without specific guiding policies, expecting sales or product management to drive these decisions will not work. Executive teams need the input of manufacturing, logistics/procurement, sales, and product Managers to truly understand how their company’s product portfolio is performing. By analyzing operations and individual product value, product pruning presents OEMs with an opportunity to achieve a higher return on investment (ROI) for products approaching maturity while still maintaining a focus on NPI and sales. Only when the stakeholders and analysis are compiled can executive leadership identify the sweet spot: the point at which the cost and drain of resources required to support these legacy products overpowers earnings. Once the sweet spot is identified and a set of policies is outlined, supportive processes across departments can be established to maintain healthy product pruning practices.

Knowing which core and legacy products to support is imperative for companies that want to succeed in the market. To help find the balance, it is critical that the right stakeholders are involved in creating the strategy that supports the pruning process. Without specific guiding policies, expecting sales or product management to drive these decisions will not work. Executive teams need the input of manufacturing, logistics/procurement, sales, and product Managers to truly understand how their company’s product portfolio is performing. By analyzing operations and individual product value, product pruning presents OEMs with an opportunity to achieve a higher return on investment (ROI) for products approaching maturity while still maintaining a focus on NPI and sales. Only when the stakeholders and analysis are compiled can executive leadership identify the sweet spot: the point at which the cost and drain of resources required to support these legacy products overpowers earnings. Once the sweet spot is identified and a set of policies is outlined, supportive processes across departments can be established to maintain healthy product pruning practices.

How to prune products for sustainment and make a profit

But what should companies do with products that have been identified for pruning but are still in demand? The thirty-year evolutionary process that turned GDCA Inc. into a specialized sustainment company gave birth to Legacy Equipment Manufacturing, bringing with it a new business model based on the indefinite support of low volume, low demand, and pruned products.

GDCA, as a Legacy Equipment Manufacturer, is structurally optimized across every department and operation to sustain and manufacture the low volume and mature legacy products that OEMs are required to discontinue. LEMs are better positioned to support these designs and are efficient at performing the business case analysis that assists in determining the sweet spot (when products should be discontinued). Whereas the effort required to support low-volume, obsolete products is an exception for an OEM, it is business as usual for LEMs. Moreover, because the company is organized only to support obsolete products, they do not represent a threat or conflict of interest to OEMs in their new product introduction (NPI) or active sales process. This new business model presents customers and OEMs with the opportunity to receive a steady new source of products and income, respectively, while strengthening customer satisfaction and loyalty.

The results of pruning in partnership with an LEM creates an extended availability of critical embedded boards. As a result, OEMs can see a higher number of product upgrades instituted by customers at their own pace. At the same time, OEMs leaning on this partnership establish a new constant supply of income in the form of overhead-free royalties from the revenue generated by the production and partnership with an LEM. The increased client satisfaction and royalties make the OEM-LEM partnership beneficial to both and offers OEMs a healthy and operational way to unlock growth potential and future revenue.